How do High Frequency Traders Make Their Money?

Michael Lewis offers a good story plus a layman introduction to high-frequency trading.

High Frequency Trading is quite a hot topic nowadays. It is a form of algorithmic trading where you gain an advantage by being faster than the other market participants. But how do high frequency traders make their money? The book Flash Boys by Michael Lewis, that I’ve recently read, is a good introduction to the topic. In this post I’ll summarize what I’ve learned from it.

HFT Strategies

The important thing is that the HFT firms do not invest, they do a short term (millisecond) speculations. They risk only small amount of money (relatively to the money they can win) and they never take positions over-night. According to the book there are three major ways in which HFT works.

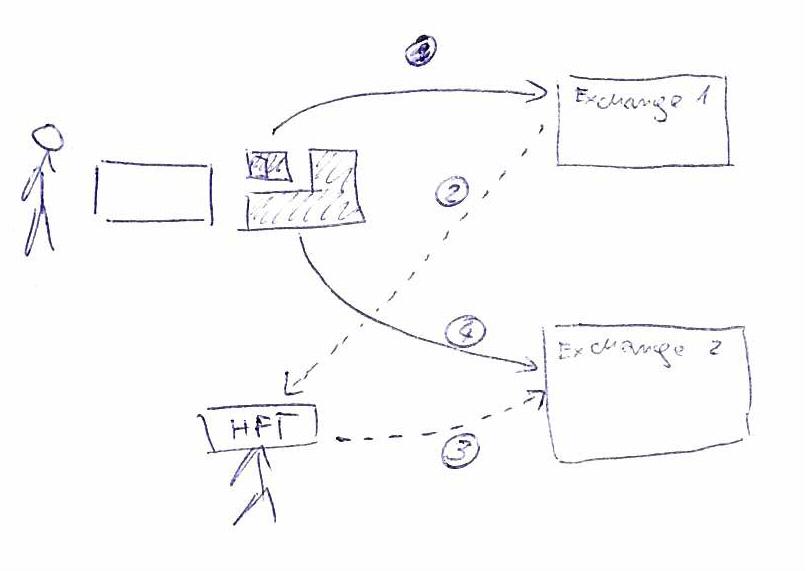

1. Electronic front running #

An HFT firm sees an investor’s action on one stock exchange and races him to the other. For example, the investor wants to buy 100.000 AAPL. Because of the size of the order, it is usually impossible to do it in one transaction on one exchange. The firm notices the first small transaction and expects more, larger ones to follow. Therefore, the firm quickly (quicker than the investor and other firms) buys the AAPL shares to sell them to the investor at higher price a few microseconds later.

How can an HFT firm know the investor’s intentions, though? There are many ways - the simplest and most reliable is to buy access to the order stream directly from a stock exchange. Firms pay a lot of money to see the stream of orders just before the other investors. The other option may be to flood the exchanges with tons of orders to buy and sell small quantities and through observing their execution predict the following parts of the transactions. Why does it work? The broker-dealers are legally obliged to execute the client’s orders at the best price, even if it means splitting them.

For example, you want to sell 10.000 GOOG. There is a buyer for the full amount (10.000) on NASDAQ at $500.95 and another buyer for 200 at $500.96 on a different exchange. Your broker will first sell 200 for $500.96/share (she has to do it), and then order selling the remaining 9800 on NASDAQ. However, by the time her order reaches NASDAQ, the 10.000 has got his shares from the HTF firms, and that is them to buy yours at a lower price.

2. Rebate arbitrage #

In the old days there were one or two stock exchanges per country with a flat commission rate paid to them for executing orders. Nowadays, there are many of them (over fifteen public exchanges in the US plus even more private exchanges, aka dark pools). Instead of a flat rate they offer sophisticated schemes of commissions and premiums paid by and given to the trading parties. The HFT firms buy and sell in a way which provides no additional liquidity, but scalps the premiums from the exchanges. For example, an exchange A pays a small premium for buying and an exchange B for selling. The HFT can race both sides of the deal to the exchanges and take the premiums.

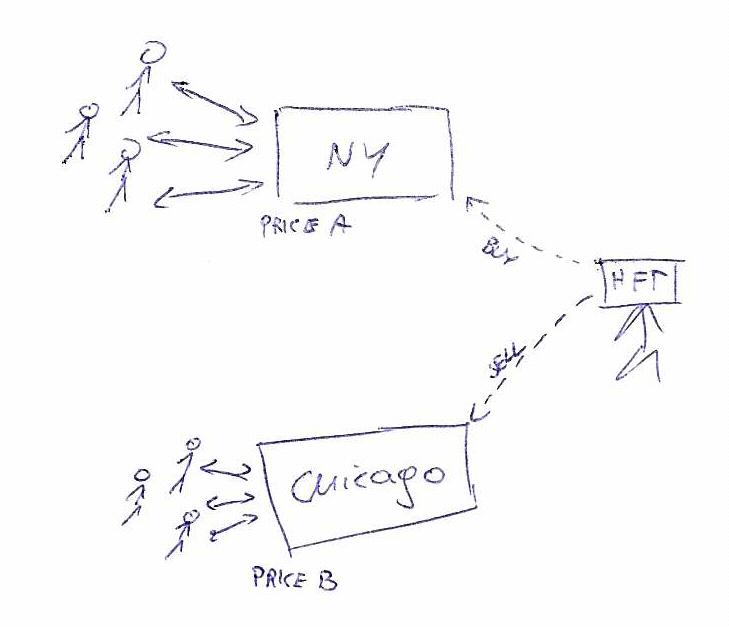

3. Slow market arbitrage #

According to the book, this is where the most of the money is made. The idea is simple, a company is traded at $100 at all of the exchanges; then a big order arrives at one of them which pushes the price a bit, say to $100.01. The fastest player can buy at $100 and sell at $100.01 taking virtually no risk.

Money at stake #

High frequency trading firms are new kind of beasts in the financial markets. They are not on the sell side, like investment banks creating new vehicles to invest in; they are not on the buy side either, like mutual funds picking the best assets. They are more like a tax the investors have to pay. Due to various features of the markets they are almost guaranteed to outrun all the regular investors (including even the biggest funds). They boast many years without losing money even a single day. They take small risks and earn huge profits at the expense of the other investors.

In the book the tax is estimated at 0.064% (a bit more than six hundredth of percent) of a trading volume. In 2009 it gave $160 million per day on the US stock market.

The challenge #

As an HFT you need to be first. The trading algorithms themselves are not exceptionally sophisticated in this business. What does matter is the raw speed. Each microsecond counts. It takes 300-400 microseconds to blink an eye (src), while high frequency traders are interested in gaining an advantage hundred times smaller. To achieve such a speed you need to be crazy about your hardware, connection lags to the stock exchange point of entry, routers, cables, everything. Of course your software also needs to be tuned for speed.

Even though, the book portraits HFT as a modern equivalent of a highwayman and their trade as a morally doubtful one, from the technological point of view it is a very interesting problem and a huge challenge. I envy a bit the engineers working there.

Book #

This book is heavily criticized by some people in mass and social media. Of course not everybody will like it. Nevertheless, a lot of the criticism comes from the people having a stake in HFT market, who therefore have good incentive to keep it obscure (src).

In my opinion, the book is great. It offers an interesting story with both positive characters and villains. You don’t need an MIT degree to follow it and yet it presents the big picture of high frequency trading in a clear and manner. It’s worth your time and attention if you’re interested even a little bit in financial markets, the technology behind them and the associated ethical challenges. It also shows a new kind of industry making great money and the attempts to tame them. I can highly recommend it.